Social Security Survivorship Challenge

Good to Know

It’s been said that there are two kinds of CFP Board exams—those that test Social Security moderately and those that test it heavily. From a larger perspective, CFP Board tells us that almost one of every five questions on the average exam will test the examinee’s knowledge of the Retirement Savings and Income Planning domain. Social Security is a key part of retirement, survivorship, and—to a lesser degree—disability planning. Before digging deeper, here’s the game plan for this article:

- The importance of the survivorship benefit,

- The Survivorship Maze,

- Scenario, key terms, and brief quiz,

- Competency assessment, and

- Summary.

We begin by emphasizing how important these benefits are to our families and clients.

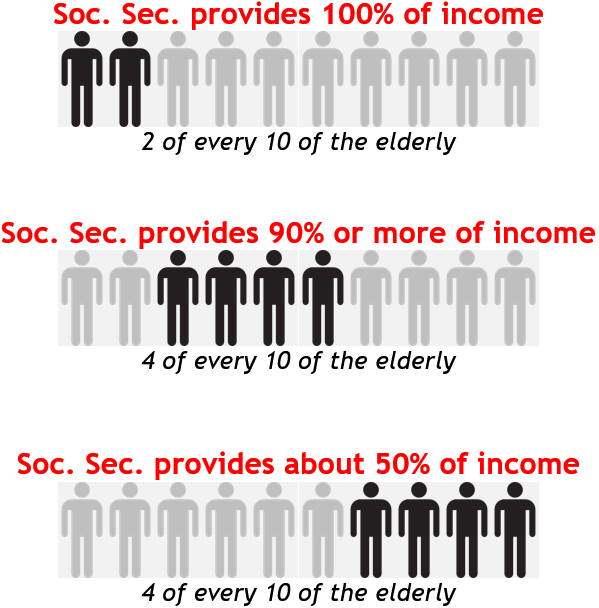

The Importance of the Survivorship Benefit

Social Security is one of the most consistently tested competencies in the Retirement Savings and Income Planning domain. Why? No one outside of the CFP Board can say with certainty, but your author suspects the following cause and effect.

- Cause—most Americans are woefully underfunded for retirement—the average 45-to-50-year-old has amassed about $250,000 for retirement and about one-half of that age cohort has saved $100,000 or less.1

- Effect—consequently, maximizing Social Security benefits becomes urgent for retirees, including the substantial number of retirees receiving survivorship benefits.

Yet there’s another challenge for the planner or advisor. How do you inform your clients through the twists and turns of the benefit-claiming rules? It turns out that may be especially true for helping clients maximize their benefits after the death of a spouse or parent. Those regulations can literally feel like a maze to your clients.

The Maze

Clients struggle to navigate the Social Security choices. For example, here are just a few of the factors that a surviving spouse may need to consider at the death of a spouse:

Clients struggle to navigate the Social Security choices. For example, here are just a few of the factors that a surviving spouse may need to consider at the death of a spouse:

- Am I eligible for survivorship benefits,

- When should I claim survivorship benefits,

- How will claiming survivorship benefits affect my own retirement benefits or my spousal retirement benefits, and

- Are my minor children (or special needs adult children) eligible for benefits?

Keep in mind the emotional context of this time for the surviving spouse—grief can be overwhelming and could cloud anyone’s ability to make the best long-term financial decisions. Next, we’ll frame a brief quiz.

Scenario, Key Terms, and Brief Quiz

Your married client expired recently; the surviving spouse has Social Security survivorship benefit questions. Before you gauge your readiness to answer those questions, let’s decrypt a select few Social Security terms.

- Covered worker—an individual who pays social security tax from their covered employment income (e.g., W2 compensation or self-employment income).

- Insured status—the covered worker’s qualifying family members are eligible to receive survivorship benefits if the deceased covered worker was fully3 and/or currently insured4 at death.

- Record—the covered worker’s social security compensation and social security taxes paid over their lifetime forms their digital “record.” Benefits are paid to beneficiaries, if they otherwise qualify, based on this record.

- Full retirement age (FRA)—age 65-67 depending upon the insured’s year of birth.

- Primary Insurance Amount (PIA)—this is the retirement benefit amount payable to a fully insured covered worker who claims their benefit at their FRA. The covered worker’s PIA is generally the maximum survivorship benefit that can be paid to a surviving spouse at their FRA.

Armed with this scenario and these key terms, you’re ready for a quick 5-question competency quiz.

1. |

A parent of a deceased covered worker is potentially eligible for survivorship benefits on the deceased covered worker’s record. Incorrect. As long as the parent is at least age 62 and receiving at least one-half of their financial support from the deceased covered worker, the parent may be eligible for survivorship benefits on a fully or currently insured covered worker’s record.

Correct! As long as the parent is at least age 62 and receiving at least one-half of their financial support from the deceased covered worker, the parent may be eligible for survivorship benefits on a fully or currently insured covered worker’s record.

|

2. |

Your client Portia is a recently widowed healthy 60-year-old. Her husband was fully insured for survivorship and retirement benefits at his death. Which of the following benefit choices, if any, are available to her? Incorrect. This choice is not available. There is no “double dipping” for Portia—she cannot receive both benefits simultaneously.

Incorrect. This choice is not available. The earliest age she can claim retirement benefits is age 62.

Correct. This choice is available and allows her to collect a survivorship benefit beginning in the current year. Further planning needs to be done to determine whether she should keep the survivorship benefit for the long term or switch to a retirement benefit at a future date.

Incorrect. A correct choice is available.

|

3. |

Your client, age 60, is an unmarried widower. He is receiving survivorship benefits on his deceased wife’s record. If he remarries at his current age, he will lose the survivorship benefits. Correct! He will not lose any of his survivorship benefits because he has reached age 60. He would have lost the survivorship benefits had he remarried before his age 60.

Incorrect. He will not lose any of his survivorship benefits because he has reached age 60. He would have lost the survivorship benefits had he remarried before his age 60.

|

4. |

Your client Mary recently died. She had been married to Ken for twenty years at her death. Mary was previously married to John for 11 years. John has not remarried. Both Ken and John are 60 years of age. Survivorship benefits paid to her most recent husband Ken may reduce survivorship benefits paid to her first husband John. Correct! John’s survivorship benefits are not subject to the family benefit limit and will not be reduced.

Incorrect. John’s survivorship benefits are not subject to the family benefit limit and will not be reduced.

|

5. |

Your client Emmy recently died. She had a dependent step-grandson—Alan—at her death. Alan is age 10. There is no provision for step-grandchildren to be eligible for survivorship benefits on Emmy’s record. Correct! There is a provision for grandchildren and step-grandchildren. Alan is eligible if his biological parents are either deceased or disabled and not contributing to his support.

Incorrect. There is a provision for grandchildren and step-grandchildren. Alan is eligible if his parents are either deceased or disabled and not contributing to his support.

|

Competency Assessment

| Number Correct | Competency Assessment |

| 3 or less | Additional study is strongly suggested. |

| 4 | You’re about as prepared as the average bear, but knowledge gaps remain. |

| 5 | Well done! You are likely to be highly competent in this topic. |

Summary

Helping clients understand how to maximize Social Security survivorship benefits transcends passing the CFP Board exam—especially for those planners and advisors who practice in this area (or have loved ones who’ve recently lost a spouse). Your competency and confidence will showcase not only your professional commitment but will likely set you apart from the so-called “competition.” Candidly, one has to wonder how a long-term retirement plan can be effectively structured without a sound understanding of how Social Security choices should be elected. Get that sound understanding through our CFP® Curriculum when you consider CFP® certification. You’ll discover a select few of the reasons our students’ pass rates are much higher than the national averages.

Stay tuned for our next “Good to Know” blog—Understanding Social Security Disability benefits.

Disclaimer

The information presented herein is provided purely for educational purposes and to raise awareness of these issues; it is not meant to provide and should not be used to provide identity theft protection, investment, income tax, risk management, retirement, estate, or financial planning advice of any kind. An experienced and credentialed expert should be consulted before making decisions relating to the topics covered herein. There are variations, alternatives, and exceptions to this material that could not be covered within the scope of this blog.

1 Retrieved from https://www.nerdwallet.com/article/investing/the-average-retirement-savings-by-age-and-why-you-need-more

2 Retrieved from https://www.ssa.gov/news/press/factsheets/basicfact-alt.pdf

3 A covered worker must be fully insured to receive retirement benefits. Fully insured status means they have earned a requisite number of credits based upon age and employment but not to exceed 40. Only 4 credits can be earned annually. One credit is earned for each $1,510 in covered earned income (2022 as indexed).

4 A covered worker is generally currently insured and therefore eligible for survivorship and disability benefits if they have earned 6 credits over the preceding three years.

5 This is an approximate average. The percentages range from below 30% to 89%.