Women’s Guide to Social Security Retirement Benefits

Good to Know

This article is the first in a series of Social Security retirement topics for women, including guides for:

- Married Women,

- Divorcees, and

- Single Women.

We begin with retirement benefits for married women.

Spousal Retirement Benefits

We don’t have to like certain demographic facts to help our clients plan around them. Here’s a case in point — as a demographic, women tend to live longer and, in many cases, have lower lifetime earnings. Thus, Social Security Retirement planning is a vital discipline for women. Gender disclaimer—the author respectfully acknowledges that wives often earn more than husbands. If so, the strategies expressed herein would apply to a lower-earning husband as well.

Spousal benefits can add as much as a $100,000 in benefits over a spouse’s lifetime, especially if one spouse’s record of average lifetime earnings (record) is significantly higher. When a qualifying married woman claims retirement benefits, she will automatically receive the higher of:

- Her individual benefit based on her record or

- A spousal benefit based on a percentage of her husband’s primary insurance amount (PIA)—PIA is simply the amount a social security participant would receive if they claimed their benefits at their full retirement age (66-67, based on birth year).

Noteworthy, the spousal benefit may be reduced if there are two or more children also qualified to receive retirement benefits on the husband’s record.

Claiming Age

The spousal benefit varies by age. With a claiming age of 62, a woman’s spousal benefit will be less than one-third of the husband’s PIA. In sharp contrast, the spousal benefit jumps up to 50% of the husband’s PIA if the wife claims at her full retirement age.

The spousal benefit varies by age. With a claiming age of 62, a woman’s spousal benefit will be less than one-third of the husband’s PIA. In sharp contrast, the spousal benefit jumps up to 50% of the husband’s PIA if the wife claims at her full retirement age.

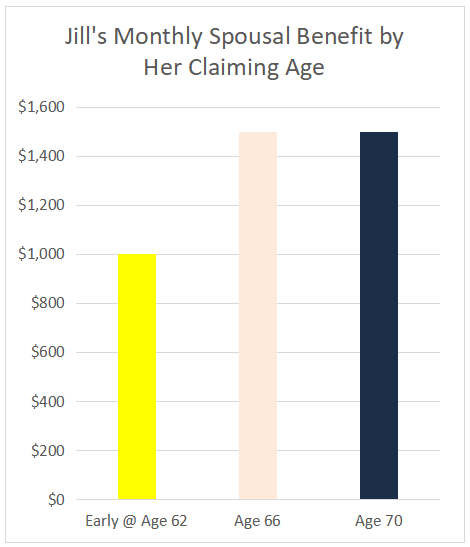

The chart to the right illustrates these rules. Assume Jack and Jill are married. Jill elected to be the primary caregiver parent and did not work outside of the home until after the children were grown and off to college. Now she works full-time but, of course, has a lower record than Jack.

Jack’s PIA, based on his average lifetime earnings, is $3,000/month. Jill’s full retirement age is 66 and her benefit, based solely on her record, is $900/month. When Jill claims her retirement benefit, she will receive the higher of a spousal benefit or a benefit calculated based solely on her record.

What does this chart tell us?

- Her annual spousal benefit is $6k higher if she waits until age 66 to claim.

- There’s no reason for her to wait past her full retirement age to claim—the spousal benefit is not eligible for delayed retirement credits.

Qualifying for Spousal Benefits

Here’s how a married woman qualifies for spousal benefits:

- Husband is collecting benefits,

- Marriage has lasted at least one year, and

- Wife must be at least age 62 or any age if caring for a qualifying child.

A qualifying child is under age 16 or disabled before age 22.

Children’s Benefit Too?

Children’s benefits can help pay the bills currently, partially fund a child’s college education, or fund technical training. A qualifying child can receive a retirement benefit of up to 50% of the retired parent’s benefit. A qualifying child is either under age 18 or disabled before the age of 22. A May-December marriage is more likely to present this opportunity than a same-age marriage. Interestingly, a 10-year old eligible child could amass as much as $50,000 during the period that ends with their eighteenth birthday.

Summary

If the couple is financially able, the lesser earning spouse could get higher spousal benefits by waiting until their full retirement age (66 to 67) to claim retirement benefits. Doing so could maximize the couple’s Social Security Retirement benefit.

Financial advisors and planners need a sound understanding of the competitive edge of joining the ranks of highly-trusted financial professionals. Get that sound understanding through our CFP® Curriculum when you consider CFP® certification. You’ll discover a select few of the reasons our student pass rates are much higher than the national averages.

The material contained in this article is to raise awareness—it is informational, general in nature and does not constitute financial advice. It should not be relied upon or used without consulting a credentialed financial professional to consider your specific circumstances. This communication was published on the date specified and may not include any future changes in the topics, laws, rules or regulations covered.