Is Your Client Using the Wrong Buy-Sell Agreement?

Good to Know

Are you looking for new ways to stay in contact with your closely held business owner clients and showcase your financial planning prowess? A recent Supreme Court decision in Connelly v. United States gives savvy financial advisors and planners an opportunity to do just that. But before getting to the court decision, we’ll briefly summarize the purposes and primary types of buy-sell agreements.

Buy-Sell Agreement

Purposes

A Buy-Sell Agreement (BSA) objectively determines the value of a closely held business owner’s interest at death, retirement, divorce, or disability. A properly structured BSA facilitates business continuation and simultaneously protects the financial interests of business owners and their families. This can be particularly critical when the business interest is the primary source of family income. What is less commonly known is that the right BSA can reduce estate taxes and legal fees when an owner dies.

Primary Types

BSA’s come in two basic structures but can be designed as a hybrid between the two.

- A redemption BSA requires the business itself to buy the decedent owner’s interest.

- A cross-purchase BSA requires the surviving owner(s) to buy the deceased owner’s interest.

Now you have context for the Supreme Court’s ruling.

Supreme Court

In Connelly, the BSA was funded with life insurance. The issue was how to treat the death benefit of $3,000,000 in valuing the company. In what some would view as a departure from tradition, the court held that the death benefit had to be included in the value of the business but the company’s liability to purchase the decedent’s ownership could not be used to reduce the valuation.

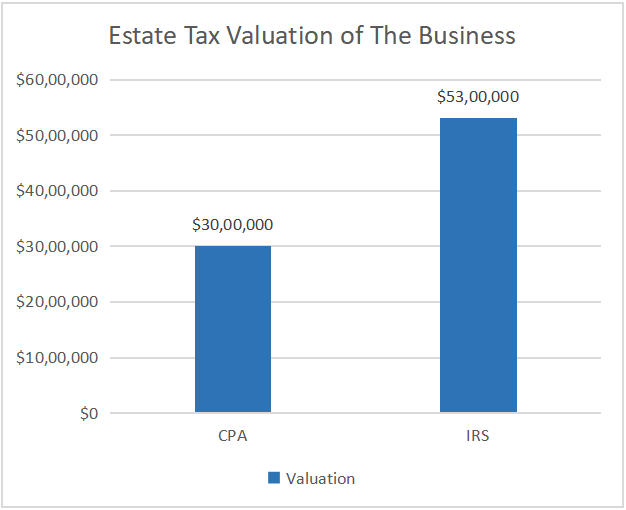

The estate hired an outside CPA firm to value the decedent’s interest at $3,000,000 on the estate tax return. But the IRS audited the return and valued the decedent’s ownership interest at a whopping $5,300,000.

There are complexities in the court’s ruling that are beyond the scope of this brief article but a cautionary tale runs throughout—a cross-purchase BSA structure is less likely to drive up estate taxes than a redemption BSA structure.

Your Oppportunity

The Connelly family lost over $1,000,000 in additional estate taxes and legal fees in fighting the IRS because—in the court’s opinion—the buy-sell agreement used a redemption structure. Here’s the bottom line for savvy Financial Advisors with closely held business clients—after receiving approval from your compliance team, reach out to these clients to make them aware of this risk.

Financial advisors and planners need a sound understanding of the competitive edge of joining the ranks of highly-trusted financial professionals. Get that sound understanding through our CFP® Curriculum when you consider CFP® certification. You’ll discover a select few of the reasons our student pass rates are much higher than the national averages.

The material contained in this article is to raise awareness—it is informational, general in nature and does not constitute financial advice. It should not be relied upon or used without consulting a credentialed financial professional to consider your specific circumstances. This communication was published on the date specified and may not include any future changes in the topics, laws, rules or regulations covered.