Correlation Coefficient and Diversification

Course: Investment Planning

Lesson 13: Asset Allocation

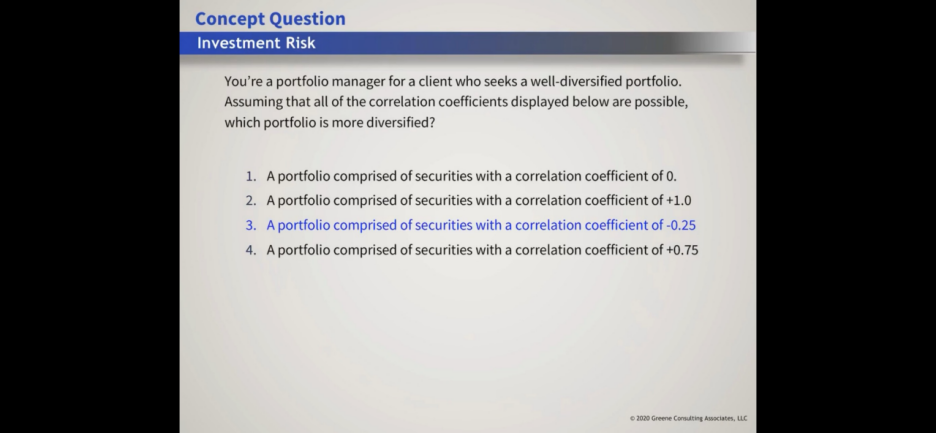

Student Question:

In the attached concept question, wouldn’t Option (1) – a correlation coefficient of 0 – be the most diversified since there is no correlation? A correlation of -.25 would indicate a slight negative correlation.

Instructor Response:

Good to hear from you again! Hope all is going well.

These can always be tricky. Don’t confuse correlation with diversification.

If we have a 1.0 correlation, the securities will move perfectly together. That gives us no diversification.

If we have a correlation of 0.0, there is no linear relationship. This provides us moderate diversification since movement of one asset doesn’t give us any indication how another will move. Totally random.

A correlation of -1.0 means the assets would move in the complete opposite direction. In other words, this is the maximum possible diversification.

So given the above, a correlation of -0.25 would have more diversification than 0.0.

Does that help clarify? Let me know any additional questions.