Does Your Client Really Need an Estate Plan?

Good to Know

How many of your clients think a great evening is sitting around a roaring fireplace on a cold night, drinking an excellent Merlot, and discussing death with their sweetheart? The author’s guess (and hope!) is about zero. Yet, even though that romantic setting is not the best time to discuss estate planning, the lack of an estate plan is one of the most unappreciated urgencies that a thinking client needs to address.

Here’s the gameplan for this article:

- Establishing the need for an estate plan,

- A short quiz to emphasize the urgency of an estate plan, and

- A financial professional’s value added in helping clients develop an estate plan.

The Need for an Estate Plan

Estate plans are almost exclusively about protecting wealth, right? The author’s response is a resounding “no” for most clients. Why? Without an estate plan, who will:

- Care for minor children, special needs adult children, or dependent parents if both your client and their spouse die simultaneously,

- Manage any inheritance left for the benefit of loved ones,

- Make medical and legal decisions for your client if they are incapacitated,

- Determine whether or not your client is kept alive artificially if in a vegetative state, and

- Make medical decisions for the care of unmarried, incapacitated adult children?

The following documents are required for an effective estate plan:

- Last Will and Testament,

- Power of Attorney for health care,

- Power of Attorney for financial assets, and

- Advance Directive for Health Care.

Some clients may also need revocable or irrevocable trusts as well.

Next is a short exercise for perspective.

Quiz

1. |

Of every ten Americans, about how many lack an estate plan?1 Incorrect.

Correct! 37% of Americans lack an estate plan.

|

2. |

What is the primary reason Americans do not have an estate plan? Incorrect. Surprisingly, this is far from the most often cited reason. Only about 1 of every 10 Americans without an estate plan ascribed this fear as the cause.

Incorrect. This is a close second, but not the primary reason.

Incorrect. This is the third most often cited reason.

Correct!

|

Think through this for a moment. The most often cited reason for lacking an estate plan is based upon a false premise! Namely that estate plans are unneeded unless one is wealthy.

Working with a Financial Professional

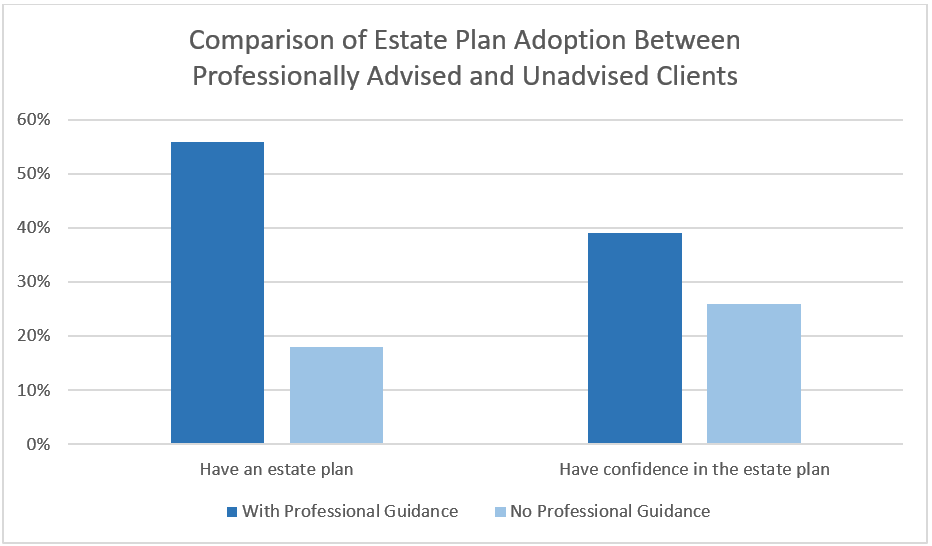

Here’s where a savvy Financial Planner or Financial Advisor can add value. Let’s compare the sobering lack of an estate plan with and without a financial professional’s guidance.

Takeaways

In life and on the CFP Board exam, an estate plan should be part of any comprehensive financial plan. A CFP® certificant needs a sound understanding of this part of the financial planning process. Get that sound understanding through our CFP® Curriculum when you consider a CFP® Curriculum. You’ll discover a select few of the reasons our students’ pass rates are much higher than the national averages.

Disclaimer

The information presented herein is provided purely for educational purposes and to raise awareness of these issues; it is not meant to provide and should not be used to provide identity theft protection, investment, income tax, risk management, retirement, estate, or financial planning advice of any kind. An experienced and credentialed expert should be consulted before making decisions relating to the topics covered herein. There are variations, alternatives, and exceptions to this material that could not be covered within the scope of this blog.