Early Holiday Gifts from Secure 2.0 Act

Good to Know

Secure 2.0 Act is dramatically more impactful than is commonly appreciated. Not-to-be-missed “gift” opportunities range from employer 401(k) plan matches for student loan repayments to Roth account rollovers from 529 plans and more. This article will summarize the most powerful opportunities.

Secure 2.0 Act is dramatically more impactful than is commonly appreciated. Not-to-be-missed “gift” opportunities range from employer 401(k) plan matches for student loan repayments to Roth account rollovers from 529 plans and more. This article will summarize the most powerful opportunities.

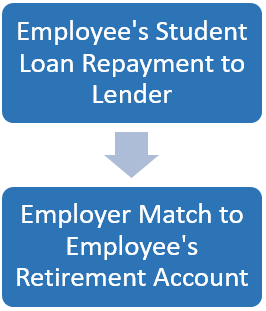

Employer 401(k) Match for Student Loan Repayments

Employers have the option (not the requirement) to make matching contributions to eligible retirement plans for employee student loan repayments effective for years beginning on or after January 1, 2024. Eligible retirement plans include 401(k), 403(b), 457(b), and SIMPLE IRA plans. A qualified student loan repayment is made by the employee to an eligible institution and (apparently) includes payment for the employee, their spouse, or their dependent—additional detailed guidance is expected from the IRS. Eligible institutions are institutions that qualify for federal student aid.

Employers have the option (not the requirement) to make matching contributions to eligible retirement plans for employee student loan repayments effective for years beginning on or after January 1, 2024. Eligible retirement plans include 401(k), 403(b), 457(b), and SIMPLE IRA plans. A qualified student loan repayment is made by the employee to an eligible institution and (apparently) includes payment for the employee, their spouse, or their dependent—additional detailed guidance is expected from the IRS. Eligible institutions are institutions that qualify for federal student aid.

New Designated Roth Accounts

SIMPLE IRAs and SEP IRAs could not include Designated Roth Accounts (DRAs) before 2023; the Secure 2.0 Act now allows—but does not require—an employer to include DRAs in these IRA-based employer-sponsored plans effective for years beginning on or after January 1, 2023.

529 Plan to Roth Rollover

What if your son or daughter does not use all of their 529 College Savings Plan funds? Effective for years beginning on or after January 1, 2024, there’s an intriguing new option for the unused 529 balance that can jump-start the student’s retirement planning—a rollover from the 529 plan to a Roth IRA. These rollovers are subject to requirements such as:

- The Roth IRA account must be in the name of the 529 plan beneficiary,

- The 529 plan must have been open and funded for at least 15 years,

- The rollover cannot exceed the annually indexed contribution limit for the Roth IRA, and

- A maximum lifetime limit of $35,000 may be rolled over from the 529 plan to the Roth IRA.

Emergency Savings Account

Employers may—but are not required to—add an emergency savings account option to their 401(k) or other employer-sponsored plan—which must be designated as an after-tax account. Total employee contributions cannot exceed $2,500 annually and employers may match up to 100% of employee contributions, depending on plan design. An employee’s withdrawals from the emergency savings account are income-tax and penalty-free.

Employers may—but are not required to—add an emergency savings account option to their 401(k) or other employer-sponsored plan—which must be designated as an after-tax account. Total employee contributions cannot exceed $2,500 annually and employers may match up to 100% of employee contributions, depending on plan design. An employee’s withdrawals from the emergency savings account are income-tax and penalty-free.

The Bottom Line

Savvy financial advisors and planners will invest the time needed to understand how these and other opportunities apply to their clients and prospects. Rest assured that your competition will! Click here for other Secure 2.0 Act opportunities

Disclaimer

The information presented herein is provided purely for educational purposes and to raise awareness of these issues; it is not meant to provide and should not be used to provide financial advice of any kind—including but not limited to legal, identity theft protection, investment, income tax, risk management, retirement, or estate advice. Consult an experienced, credentialed expert for detailed guidance.