TOP 4 FINANCIAL CONCERNS OF THE PANDEMIC

CFP® Certificants in the News

More than five of every ten Americans are experiencing “high” to “very high” financial stress levels as a result of the pandemic according to a survey commissioned by CFP Board and released December 3, 2020. Admittedly, that is hardly a seismic revelation. But if we dig below the headlines, you may gain insights that could help you understand and serve your clients more effectively.

Our focus in this brief blog is upon:

- The top 4 stressors among all respondents surveyed,

- Top stressors by generation,

- CFP Board’s perspective on health care,

- Perception of worsening economic conditions, and

- Survey methodology.

We will rely upon excerpts from CFP Board’s article and the survey itself to inform this discussion, beginning with financial stressors among all Americans.

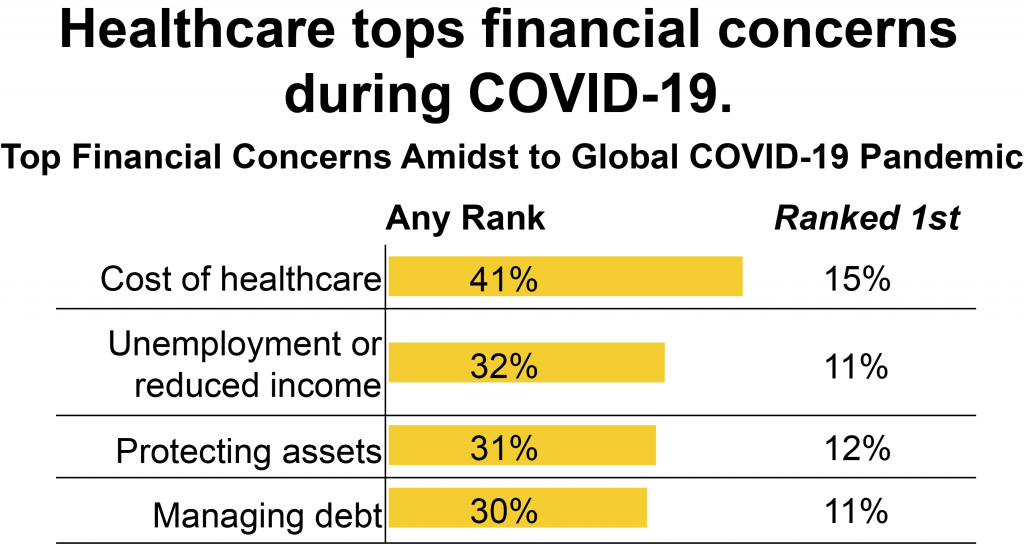

Top 4 Financial Stressors for Americans

Noteworthy – Retirement savings, taxes, and rent/mortgage payments were roughly tied for fifth place among financial stressors.

Top Stressors by Generation

The “hot spots” of stress differ dramatically by generation.

| TOP STRESSORS BY GENERATION | ||

| TOP STRESSOR | GENERATION | BIRTH YEAR |

| Protecting accumulated assets | Silent Generation | 1921 - 1945 |

| Health care costs | Baby Boomers | 1946 - 1964 |

| Health care costs | Gen X1 | 1965 - 1980 |

| Unemployment | Millennials | 1981 - 1994 |

| Student debt payments | Gen Z1 | 1995 - 2002 |

1 The survey was not explicit about the top concern in this generation. These concerns are based on other surveys and the implications of the article.

“There are distinct differences between generations when it comes to stress levels and top financial concerns.

- Younger respondents tend to experience higher levels of stress, with Gen Z (60%) and Millennials (64%) reporting high or very high levels of stress.

- Their older counterparts are also stressed but tend to be less stressed than their younger counterparts, with 46% of Baby Boomers and 28% of the Silent Generation reporting high levels of worry.

Older respondents indicated they are more concerned about the cost of their healthcare, with 46% of Baby Boomers and 50% of the Silent Generation responding that it is a top financial concern. This is likely due to that group of individuals being especially vulnerable to the effects of the pandemic combined with their heavy reliance on Medicare. Millennials are most concerned about unemployment or reduced income (40%) whereas the Silent Generation is most concerned about protecting assets (59%).”

Our commentary: COVID-19 worries exacerbate our clients’ normal financial concerns either directly or indirectly. For example, COVID-19 costs could threaten the premature depletion of retirement assets (Silent Generation/Older Baby Boomers) or delay retirement (Baby Boomers and early Gen X). In addition, business closures and downsizing make finding and keeping a job a significant worry for Millennials and Gen Z. Specific to Gen Z, paying off student debt is always a concern but is especially pronounced in the current uncertain jobs market.

CFP Board Weighs in on Health Care

“The uncertainty and volatility of this past year have strained Americans physically, mentally, emotionally and financially,” said CFP Board CEO Kevin R. Keller, CAE. “Given the impact of the COVID-19 pandemic across the country and the recent surge in cases, it is understandable that Americans are most concerned with the cost of their healthcare.”

Perceptions of Worsening Personal Economic Situations

“Americans are more concerned about their personal economic situations than before. In early March 2020, 25% of respondents said their personal economic situations were worse than four years ago. While in November 2020, 34% of respondents said their personal economic situations were worse than four years ago; a percentage increase of 9 percentage points.”

Survey Methodology

The online survey was conducted November 3, 2020, among a total national sample of 2,005 adult respondents 18 years of age and older, including a nationally representative subsample of n=1,000 adult respondents 18 years of age and older who were asked a set of questions on financial topics.

Takeaway – Financial Planning Reduces Financial Stress Levels

“Respondents who work with a financial professional experience similar levels of day-to-day stress, with 53% reporting high levels of anxiety. However, those who work with a financial planner are less concerned about the cost of healthcare than those who do not (36% vs. 43%) and much less concerned about unemployment or reduced income (22% vs. 36%). Additionally, those working with a financial planner are less concerned about managing debt (18% vs. 35%) and making rent or mortgage payments (13% vs. 32%) than those who do not have a financial planner.

A financial planner can help lessen Americans’ financial concerns by addressing important topics such as reduced income, managing debt, or paying bills within the context of their financial plans. Working with a CFP® professional, who is obligated to the CFP Board to serving their client’s best interests, can help navigate today’s challenges and also plan for a more secure tomorrow…”

Disclaimer

The CFP Board survey was taken before the announcement of an approval for COVID-19 vaccines. We can theorize that financial stress levels may have moderated at least to some degree in the wake of vaccine approvals, but this is pure conjecture until further studies are performed.

The information presented herein is provided purely for educational purposes and to raise awareness of these issues; it is not meant to provide and should not be used to provide legal, compliance or financial advice. There are variations, alternatives, and exceptions to this material that could not be covered within the scope of this blog.