What Can A Children’s Story Teach Us About Retirement Savings?

Good to Know

A financial planner’s or advisor’s role can be as much about implementation as it is about inspiration. The best retirement savings plan in the history of humankind may be doomed to failure when a client is disengaged or procrastinates. Sadly, too many of our clients understand the importance of putting the plan into practice logically, yet fail to take the first step—thereby putting their retirement income at peril. Consider the Smith and the Jones family below for example.

The Smith Family

The Smith family has a small child, a mortgage, and a need to start saving for college. They may be hard-pressed to save significant amounts for retirement until college is fully funded. That’s understandable—many of us have been there! However, the author respectfully suggests that waiting to save significant amounts for retirement—although a natural temptation—can cause us to have to work longer than planned or accept a less-than-planned lifestyle.

The Smith family has a small child, a mortgage, and a need to start saving for college. They may be hard-pressed to save significant amounts for retirement until college is fully funded. That’s understandable—many of us have been there! However, the author respectfully suggests that waiting to save significant amounts for retirement—although a natural temptation—can cause us to have to work longer than planned or accept a less-than-planned lifestyle.

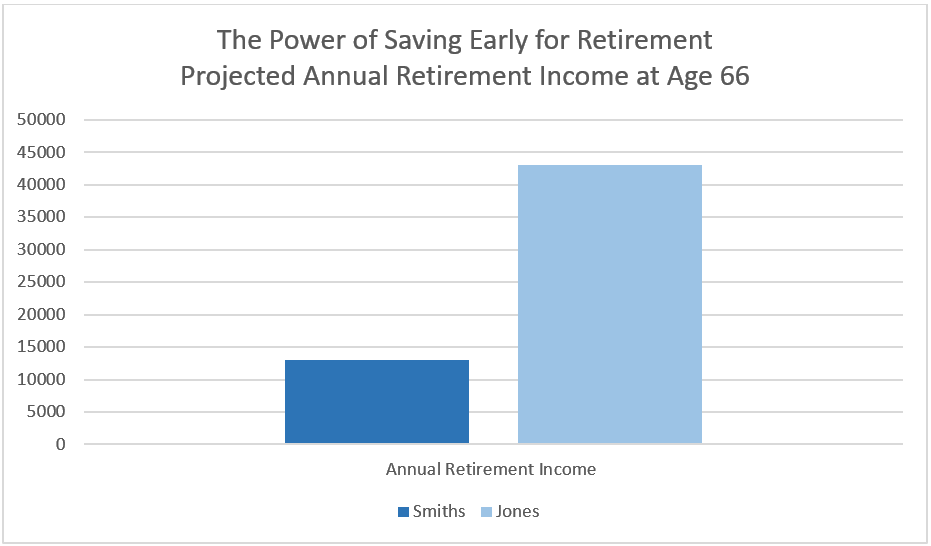

The Smith family began saving for retirement at age 40. They deferred 6% of their compensation on a tax-deferred basis into their respective 401(k) plans. Assuming a 6% annual return, they will accumulate just over $177,000 by age 66—providing an annual income stream of just under $13,000 from age 66 to age 90.

The Jones Family

The Jones family began saving for retirement at age 25. They deferred 6% of their compensation on a tax-deferred basis into their respective 401(k) plans even though they had to buy a smaller home than they could have afforded otherwise. Assuming a 6% annual return, they will accumulate just over $495,000 by age 66—providing an annual income stream to the Jones family of over $43,000 from age 66 to age 90.

The Jones family began saving for retirement at age 25. They deferred 6% of their compensation on a tax-deferred basis into their respective 401(k) plans even though they had to buy a smaller home than they could have afforded otherwise. Assuming a 6% annual return, they will accumulate just over $495,000 by age 66—providing an annual income stream to the Jones family of over $43,000 from age 66 to age 90.

Comparison

The Bottom Line

“Nothing worth having comes easy”

-Theodore Roosevelt

Our former President may have been on to something when he coined this oft-quoted phrase. A savvy financial advisor coaches their clients to begin saving as much as possible—even if that means making hard budgetary choices—as early as possible. Let’s face it, a Tortoise is neither glamorous nor sexy (no hate mail from Tortoise lovers please). But the Tortoise strategy may be more likely to see your clients on the beach, sipping an adult beverage at sunset, in retirement.

Disclaimer

The information presented herein is provided purely for educational purposes and to raise awareness of these issues; it is not meant to provide and should not be used to provide legal, identity theft protection, investment, income tax, risk management, retirement, estate, or financial planning advice of any kind. An experienced and credentialed expert should be consulted before making decisions relating to the topics covered herein. There are variations, alternatives, and exceptions to this material that could not be covered within the scope of this blog.